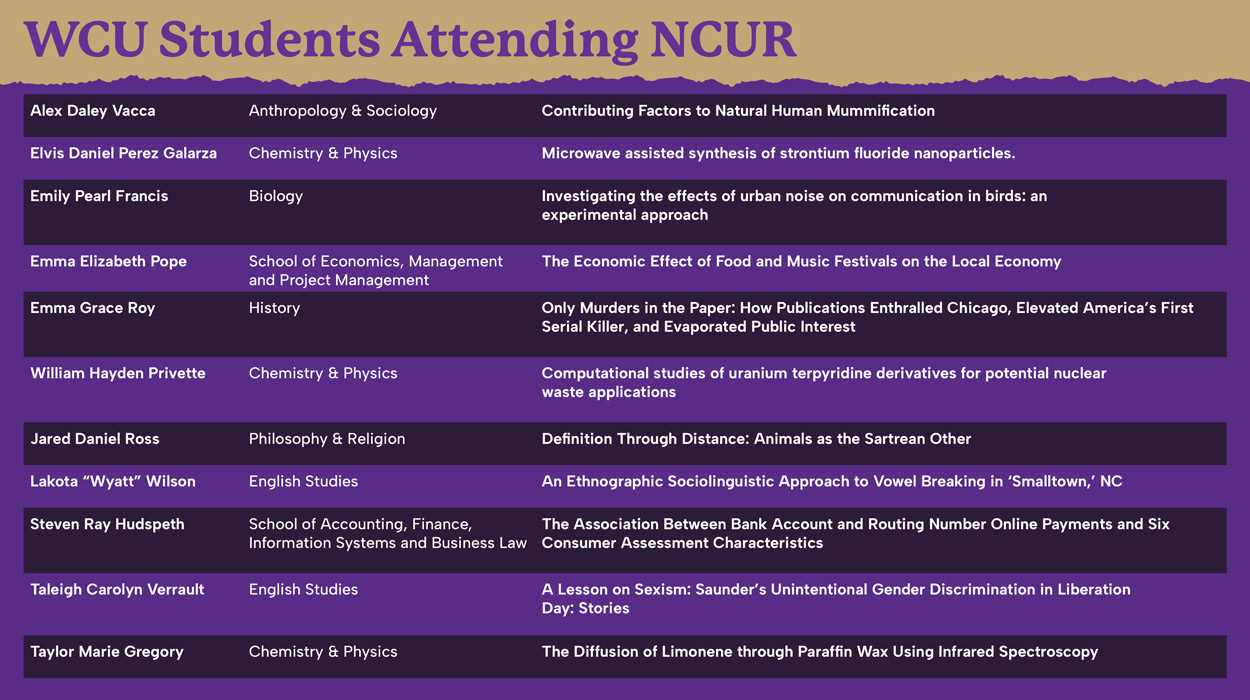

Business savvy student puts skills to use for NCUR project

Steven Hudspeth

By Julia Duvall

During his childhood, Western Carolina University student Steven Hudspeth, a junior from Gastonia, used to go on day trips with his grandmother and siblings to see the Blue Ridge Parkway from the Western North Carolina side.

He loved seeing the mountains each trip and kept those childhood memories close.

“We never went to the beach, it was always the mountains that we loved to go visit,” Hudspeth said.

Fast forward a few years later, Hudspeth knew that after graduating from Gaston Community College, he wanted to continue his education at WCU and be surrounded by the mountains from his childhood.

Having his school choice solidified, it was now time for Hudspeth to decide on a major and concentration. Always having an interest in business, he knew he wanted to help people achieve their financial goals, so he chose the financial planning concentration in WCU’s College of Business’ finance program.

“I was meeting with my adviser, Dr. (Gary) Curnutt, and he mentioned the National Conference on Undergraduate Research and all of the opportunities available to students,” Hudspeth said. “Initially, I was unsure if that was something I would want to do but learning more about NCUR and having Dr. Curnutt send me all of the information, I became very interested in submitting a research project.”

Hudspeth’s research paper, “The Association Between Online Payments Using Different Payment Types and Six Consumer Assessment Characteristics,” looks at the relationship between online payments using various types of payments, such as cash, checks, debit cards, credit cards, prepaid cards, money orders and bank account number payments during COVID-19, and six characteristics used to assess payment choice.

“During COVID-19, there was a significant uptick in online payments due to the restrictions stemming from the pandemic, which shifted how businesses catered to their customers in person and online,” he said. “While researching, I ended up stumbling upon the 2020 Survey of Consumer Choice published by the Federal Reserve Bank of Atlanta,” Hudspeth said.

Hudspeth used that model for his study to see the association between online payments and the six consumer characteristics which are security, acceptance, getting and setting up, cost, convenience, and payment record.

“Collaborating on research with Steven has been incredibly rewarding,” Curnutt said. “Throughout our research, Steven has consistently demonstrated qualities that exemplify a great researcher. He possesses a profound intellectual curiosity, seeking to deepen his understanding of fundamental theories and their implications on model design, as well as the assumptions underlying our hypotheses.”

Preliminary results indicated a statistically significant association between payment records and cash, payment records and credit cards, security and prepaid cards, acceptance for payment and bank account number or routing number payments.

“After we ran the model characteristics some things lined up with our hypothesis,” Hudspeth said. “Essentially our hypothesis was based on perceived ease of use or perceived usefulness. The control variable for education level showed a significant statistical association between all education levels and all payment types.”

After working on this project, Hudspeth said he would like to continue his higher education journey in financial planning and conduct more research.

“I've thoroughly enjoyed working with Steven and I certainly look forward to future research collaborations,” Curnutt said.